What is the difference between bookkeeping and accounting?

Oct 08, 2020

What is the difference between bookkeeping and accounting?

Accounting and bookkeeping are two crucial parts of managing the finances of your business. At first look, both of these practices may seem similar; however, there are some major differences.

Together bookkeepers and accountants help you make informed decisions as well as avoid issues like embezzlement and fraud. In this post, we take a look at the top five differences between bookkeeping and accounting.

Definition

Bookkeeping is focused on measuring, recording and organising your financial data. However, accounting involves summarising, interpreting and presenting the financial data to business owners and investors.

Decision making

The management cannot take decisions based on the information provided by bookkeeping. Critical decisions can only be made based on the data resulting from the accounting process.

Objective

The primary goal of a bookkeeper is to correctly record all financial transactions in a chronological, systematic and logical manner.

The main objective of an accountant is to identify the financial status or well-being of the business and report this information to the stakeholders. They are, therefore, not focused on the day-to-day tasks of bookkeeping, but instead focus on the assessment and interpretation of key financial data that has been recorded.

Analysis

The bookkeeping

process doesn’t call for analysis of any sort. The accounting process relies on the data from bookkeeping to assess it and interpret it and compile it into reports.

Financial statements

As part of the bookkeeping process, no financial statements are prepared. They are prepared as part of the accounting process.

Skills

While bookkeeping does not call for any special skills, accounting requires specialised skills given its analytics, complex nature.

Types

Essentially, there are two forms of bookkeeping – the single entry system and the double entry bookkeeping system. The accounting process is used for preparing a company’s budgets and planning loan proposals.

Scope of work

Bookkeeping generally involves invoicing, bills and receipts, payroll and recording business transactions. Accounting entails budgeting, preparing financial statements and reports, tax returns and assessing business performance.

Choose THN & Samios Partner

Both bookkeeping and accounting are critical part of your business. THN & Samios Partner

is an industry leader with over 20 years of experience. Over the years, we have helped businesses across Australia in managing their books and accounts.

Our team is comprised of professional, certified accountants who offer the best advice and service in the industry. Our bookkeepers and accountants keep with the ever-evolving landscape of accounting and are skilled to work with the latest tools and technologies.

By delegating your accounting requirements to us, you can expect to save up to 50% of your costs, while freeing up your time to focus on your core competencies and aspects of business only you can handle.

For any bookkeeping and accounting requirements,

get in touch with us

or call 02 9602 4644.

29 Apr, 2024

Explore the advantages of managing a SMSF with our comprehensive guide. An SMSF gives you unparalleled control and flexibility over your retirement investments, aligning perfectly with your unique financial goals. Delve into the broad range of investment options available and the strategic tax planning benefits you can leverage. We'll also cover the important responsibilities of running an SMSF, ensuring you’re well-informed about the challenges alongside the benefits. Learn how an SMSF can be a key component of a personalised and effective retirement strategy.

05 Jul, 2023

Deciding whether to hire an internal accountant or engage an external accounting firm can be challenging. A growing number of businesses today are opting to outsource their financial and accounting functions, driven by the multitude of benefits this approach offers. The factors many companies look at now when assessing this decision are: What are the core strengths and skills of an internal employee? What are the risks of an internal employee? How can an external employee be a more financially viable option? In today's landscape, more power is being taken from employers and given to employees, and many large companies now view hiring as a high-risk maneuver. Employers must consider leave benefits, including; sick leave, mental health days, annual leave, bereavement leave, pandemic leave, and long covid leave. The anxiety levels of employers are through the roof. Not to mention that more and more accountants are leaving the industry while less and less are studying to become accountants.

08 Oct, 2020

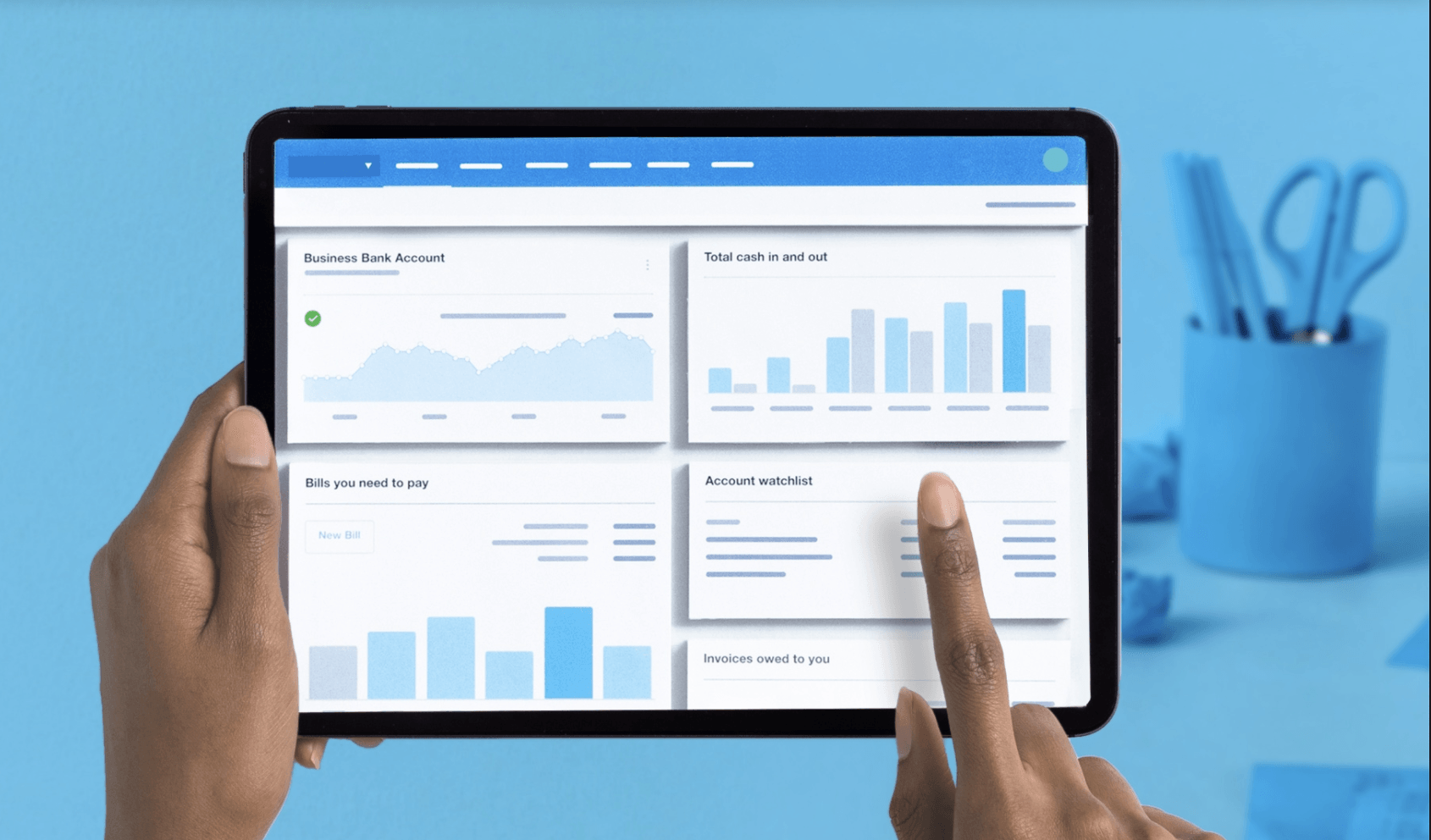

Small business accounting has rapidly changed over the past decade thanks to the exponential development in technology. Access to advanced software that can carry out complex functions and interconnected technology has made bookkeeping and accounting easier, efficient and accessible. Organising financial data, analysing it and measuring your business progress has never been easier. Here are 5 ways technology has changed small business bookkeeping. Cloud accounting The advent of cloud-based accounting systems has streamlined bookkeeping. You no longer have to install accounting software on your computer. Simply sign up and begin bookkeeping. Today’s cloud accounting programmes boast an array of features including payroll, collection and the ability to connect your bank accounts. What’s more, these programmes are designed for efficiency and productivity whilst adhering to all applicable bookkeeping and accounting guidelines. Mobile accounting Cloud computing and virtual technology have transformed the way bookkeeping is done. There are a range of mobile apps for accounting functions. Here are some of the tasks you can handle using your mobile device: • Capture receipts • Create and send invoices • Gather signatures • Create expense claims Your accountant does not have to visit your office to access the records. No matter the time of the day or where they are, they can access the data instantly. Physical location is no longer a barrier. Accounting and bookkeeping has gone truly mobile! Real time updates Business reporting is an important part of any business. It helps in making important decisions and aids in auditing aspects of operating a business. However, given the complexity of bookkeeping and accounting processes, reports may not be available readily. However, all that has changed with technology. Today’s bookkeeping platforms boast real-time reporting and data updates. When you receive a payment, your bank notifies the bookkeeper (via email, text message or even online banking), and the payment is recorded. The same holds true whether you make a sale or accrue an expense. Streamlined processes Bookkeeping is no more complex and involved process of the past. Integration between apps has streamlined the entire bookkeeping process. Integration with the bank gets rid of chasing the bank for the reconciliation process. By integrating payroll apps with the accounting software, you can save a lot of time and double-work. Improved efficiency and security Virtual bookkeeping makes things easier and effective for businesses. The virtual setup frees you up of hosting and safekeeping duties. The data, accounts and the information are easily accessible to the right people and safe from loss, theft or unauthorised modifications/changes. Delegation, checks and reporting have become a lot more efficient and optimised. Numbers and figures are less prone to errors, mistakes or manipulation. Conclusion The rapid development in technologies has changed the way businesses do bookkeeping and accounting, and that’s an undeniable fact. There are many other benefits of virtual accounting and bookkeeping. Tax time becomes stress-free when your records are efficiently organised. Not to mention the money you save by getting rid of double-work and errors.

08 Oct, 2020

Cash basis accounting and accrual basis accounting are two methods of recording transactions. The crucial difference between the two systems is the time when the transaction is recorded. If you record the transactions when you receive/pay money, it is cash basis accounting. And if you record them when you raise/receive an invoice, it is accrual accounting. We will explore both these methods in detail and consider how each method affects your business. Cash basis accounting This method recognises expenses when they’re paid and income when cash is received. This method does not track accounts payable or accounts receivable. A lot of small businesses rely on cash basis accounting as it is straightforward and pretty easy to maintain. It is quite easy to identify when a transaction has occurred (the money has been received/paid either in cash or in/out of the bank. This means that there’s no need to keep a track of payables or receivables. Cash basis accounting also helps in calculating how much cash a business has at any point of time; you can simply look at the bank balance and you know how much money you have at your disposal. Furthermore, as transactions are recorded only when the cash is received/paid, the income is not taxed until it gets to the bank. However, cash accounting isn’t accurate. It may show a business as profitable even though it has huge bills to pay. It isn’t helpful when it comes to making management decisions; there’s not much you can decipher from a day-to-day view of your finances. Accrual basis accounting Under accrual basis accounting, you record revenues and expenses as they are earned irrespective of when you receive/pay the money. For instance, you will record income when a project has been completed rather than when you receive payment. This method is the most favoured one compared to the cash method. The biggest benefit is that this method provides a more realistic picture of income/expenses, providing a long-term view of the business that cash accounting does not offer. However, this accounting method does not tell much about cash flow; a business may appear to be highly profitable where in reality its bank accounts are empty. Accrual accounting in the absence of careful tracking of cash flow could have catastrophic consequences. Accrual basis accounting requires a lot of work as you have to keep a track of invoices, not just the bank account. What’s more, you may have to pay tax on your revenue even before the customer actually settles the invoices. Which system should your small business use? To identify which method suits your business best, consider: • The size of your business • The complexity of your processes and business transactions • Whether relying on an electronic system would make a difference • Whether you have the time and resources for accrual accounting Cash basis method works well for small businesses that do not carry any inventory. If your business maintains a lot of inventory, your accountant will likely recommend the accrual method.

Contact Info

Address:

Suite 2, Level 29, 259 George St Sydney NSW 2000

Phone:

+61 2 9660 8555

Trading Hours

Monday to Friday 9:30am – 4:00pm

Appointments outside these times are available only by prior arrangement.

© 2024

THN & Samios Partners Pty Ltd