How to Reduce Taxable Income in Australia: Practical Tips

When people ask how to reduce their taxable income in Australia, the answer boils down to two core strategies: boosting your allowable deductions and making smart use of tax-effective structures like superannuation.

The goal is to legally lower the amount of income the Australian Taxation Office (ATO) can tax. This usually involves claiming every single work-related expense you're entitled to or making pre-tax contributions to your super.

Understanding You r Taxable Income

- Employment income (your salary, wages, and any bonuses)

- Business income

- Investment returns (interest from savings, share dividends, rental income)

- Capital gains

- You must have spent the money yourself and weren't reimbursed by your employer.

- The expense must directly relate to earning your income. There has to be a clear link between the cost and your job.

- You must have a record to prove it, like a receipt, invoice, or bank statement.

- Vehicle and travel expenses: This covers using your own car for work-related trips, like visiting clients or travelling between different work sites (but not your normal daily commute to and from home).

- Clothing and laundry: You can claim the cost of buying and cleaning occupation-specific clothing, protective gear, or uniforms that feature your employer's logo.

- Self-education expenses: If you undertake a course or training that is directly relevant to your current job and is likely to improve your skills, the fees are generally claimable.

- Tools and equipment: The cost of buying or leasing equipment you need for work—from a mechanic's tools to a specialised laptop for a software developer—is deductible.

- Salary Sacrificing: This is an arrangement with your employer where they direct a portion of your pre-tax salary straight into your super. It’s a fantastic ‘set and forget’ method for regular contributions.

- Personal Deductible Contributions: You can also make contributions from your own bank account and then claim a tax deduction for that amount when you lodge your tax return. This is ideal for the self-employed or if your employer doesn't offer salary sacrificing.

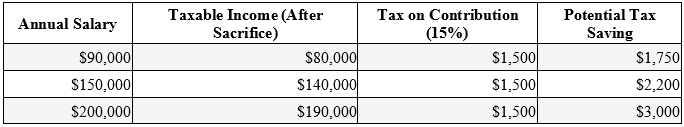

The table below shows how a $10,000 salary sacrifice could work at different income levels, giving you a clear picture of the potential tax savings.

Note: These figures are illustrative and based on 2024–25 tax rates, excluding the Medicare levy. Actual savings depend on individual circumstances.

As you can see, the higher your income, the more valuable this strategy becomes because you're saving tax at a higher marginal rate.

Staying Within The Caps

While this is a great strategy, there are limits. The ATO sets an annual cap on concessional contributions, and exceeding it can trigger extra tax. It’s vital to keep track of all your contributions, including the compulsory super guarantee payments made by your employer.

One important rule to note: high-income earners (those with a combined income and super contributions over $250,000) may face an additional 15% tax on their contributions, known as Division 293 tax.

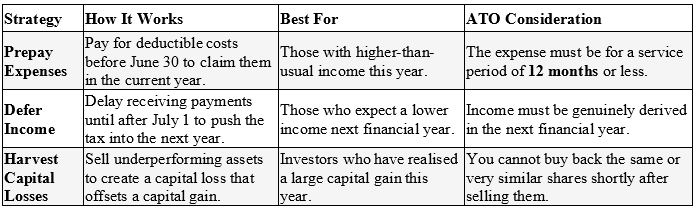

This infographic gives a quick snapshot of other common ways Australians reduce their taxable income, which can work hand-in-hand with smart super strategies.

As the visual shows, a solid tax reduction plan isn't about just one thing; it's about combining different strategies, from claiming work-related expenses to making savvy super contributions.

By consistently putting extra into your super, you're not just paying less tax today—you're building a much healthier nest egg for your future, powered by decades of compounding returns.

If you’re looking for even more control over your retirement funds, take a look at our guide on whether a self-managed super fund is right for you.

Exploring Salary Packaging and Fringe Benefits

Salary packaging, often called salary sacrificing, is one of the smartest ways to lower your taxable income in Australia. The idea is simple: you arrange with your employer to receive less in your take-home pay, and in return, they cover certain personal expenses for you using your pre-tax salary.

Because these costs are paid before tax is calculated, your total taxable income shrinks. For many people, this adds up to significant savings over the year, and it’s not just about super.

What Can You Typically Package?

Every workplace has its own rules, but a few common items pop up in most salary packaging arrangements.

- A Car via a Novated Lease: This is easily one of the most popular options. A novated lease lets you bundle your car and all its running costs—fuel, insurance, rego, servicing—and pay for it all straight from your pre-tax income.

- Portable Electronic Devices: Laptops, tablets, and mobile phones that you use mainly for work are often eligible. It’s a fantastic way to fund the tech you need without paying tax on that money first.

- Other Work-Related Expenses: Think things like self-education courses, professional association fees, or even income protection insurance. Some employers will let you include these in your package too.

The benefit is crystal clear. Let’s say you package a $2,000 laptop. That’s $2,000 instantly removed from your taxable income. If you’re in the 32.5% tax bracket, that’s a direct tax saving of $650 right there.

Understanding Fringe Benefits Tax

Here’s the catch you need to know about. When an employer provides an employee a non-cash benefit like this, it can trigger Fringe Benefits Tax (FBT). This tax is paid by your employer, not you.

However, the cost of that FBT is usually passed back to you within your salary package, so it’s essential to know how it works.

The good news is that some of the best items to package are either exempt from FBT or receive concessional treatment. Work-related laptops, for instance, are often FBT-exempt. If you want to get into the nitty-gritty, we’ve broken down the rules in our guide to Fringe Benefits Tax explained on our blog.

A well-structured salary package ensures that the tax savings you gain are greater than any FBT costs incurred. Always do the maths to confirm the arrangement puts you ahead financially.

Special Benefits for Certain Sectors

For people working in specific industries, the perks of salary packaging get even better. If you work for a public benevolent institution (like many charities) or a public hospital, the government allows for more generous packaging arrangements.

For example, eligible health and charity workers can package up to $9,010 and $15,900 respectively each year on everyday living expenses. This can include things like mortgage payments, rent, or even credit card bills—all FBT-free.

This is a massive advantage that can dramatically boost take-home pay and is a major reason people choose to work in these sectors. If you’re eligible, it’s one of the most powerful tax-reduction tools you’ll find in Australia.

The Smart Way to Time Income and Expenses

When it comes to your tax bill, when you receive income and when you pay for expenses can make a huge difference. It’s a powerful but often overlooked strategy that’s all about timing your moves around the end of the financial year.

The idea is pretty straightforward: bring your deductions forward into the current financial year and, if possible, defer receiving income until the next. This simple shift can have a massive impact, especially if your income fluctuates from one year to the next.

Bringing Deductions Forward Before June 30

One of the most effective ways to lower your taxable income is to prepay for deductible expenses before June 30. This allows you to claim the deduction in the current financial year instead of waiting another 12 months.

Think about the costs you can pay in advance. The ATO generally allows prepayments for items where the service period is 12 months or less, such as:

- Professional Subscriptions and Memberships: Got an annual industry fee? Pay it in June and claim the whole lot this year.

- Insurance Premiums: You can often prepay for 12 months of income protection or business insurance.

- Interest on Investment Loans: If you have a loan for an investment property or share portfolio, prepaying the interest for the next year can be a smart move.

- Work-Related Education: Enrolling and paying for that professional development course before the EOFY locks in the deduction right now.

This tactic is especially useful if you’ve had a particularly high-income year. Those deductions will work harder for you by offsetting income at a higher marginal tax rate.

Deferring Income to the Next Financial Year

On the flip side, sometimes it’s better to delay receiving income until after July 1. This pushes the tax liability into the next financial year, which is a great strategy if you expect your income to be lower then.

A classic example is for contractors or consultants. If you have the flexibility, you could time your invoicing so that a large payment hits your bank account in July instead of June. That simple delay means the income won’t be counted in this year’s tax assessment.

A word of caution: this is about smart timing, not tax evasion. The ATO has clear rules around when income is officially earned. Make sure any deferral lines up with your legal and contractual obligations.

Managing Capital Gains and Losses

Timing is also everything when you’re dealing with investments like shares or property. When you sell an asset for more than you paid, you create a capital gain, and that profit gets added to your taxable income for the year.

If you’ve sold an asset and realised a big gain, you can offset it by selling another asset that’s currently sitting at a loss—all within the same financial year. This is called tax-loss harvesting, and it can help you reduce or even completely wipe out the tax you owe on your gains.

Here’s a quick rundown of these timing strategies to help you see how they fit together.

Timing Strategies for Tax Reduction

Getting the timing right on these key financial moves can save you a significant amount of money come tax time. It’s all about planning ahead and making the calendar work for you.

A Few Common Tax Questions Answered

When you start digging into tax deductions and offsets, a lot of questions pop up. Getting the right answers, straight from ATO guidelines, is the only way to feel confident you're legally trimming your taxable income. Here are a few of the most common queries we tackle for clients.

Can I Claim My Travel To and From Work?

This is a big one, and for most people, the answer is no. The daily trip from your home to your primary workplace is considered private travel by the tax office, so those costs aren't deductible.

But there are some important exceptions. The Australian Taxation Office (ATO) will let you claim travel costs if your job requires you to, for example:

- Travel directly between two different workplaces during your workday.

- Drive from your main workplace to an alternative one (and then back again).

- Transport bulky tools or equipment essential for your job, but only if they genuinely can't be stored securely at your workplace.

A classic example is a tradesperson who has to transport heavy ladders and a full set of power tools from their home to various job sites. In that case, the travel is a necessary part of doing the job, not just getting to the job. That's the key distinction.

What’s the Real Difference Between a Tax Deduction and a Tax Offset?

Understanding this is fundamental to smart tax planning. While both will reduce the tax you pay, they work in completely different ways.

A tax deduction reduces your taxable income. The actual dollar value of that deduction depends on your marginal tax rate. A $100 deduction is worth more to someone in the top tax bracket than it is to someone earning a lower income.

On the other hand, a tax offset (sometimes called a tax credit) directly reduces your final tax bill, dollar-for-dollar. A $100 tax offset will cut your tax payable by exactly $100, no matter how much you earn.

Here’s a simple way to think about it: a deduction is like a discount on the price of an item before the total is calculated. An offset is like a voucher you apply to the final bill. Offsets are often designed to give a more even benefit across all income levels.

Do I Really Need to Keep Receipts For Absolutely Everything?

Good records are the foundation of a tax return that won't cause you sleepless nights. For almost every expense you claim, you need solid proof—a receipt, an invoice, or a bank statement—to show the ATO if they ask.

That said, there are a couple of small exceptions. The ATO lets you claim up to $300 total for work-related expenses without receipts, as long as the claims themselves are legitimate. You can also claim laundry expenses up to $150 based on a reasonable estimate ($1 per load for a mixed wash) without written evidence.

But relying on these is not a smart strategy. The best practice, without a doubt, is to keep a digital or physical record of every single work-related purchase you make. That discipline ensures you can confidently claim everything you're entitled to and have the evidence to back it up.

Navigating these rules is where professional advice really shows its value. At THN & Samios Partners Pty Ltd, we help business owners and individuals move past basic compliance to build smart, strategic tax plans that protect your wealth. Discover how our proactive approach can make a real difference by visiting us at https://www.samiospartners.com.au.

Disclaimer: The information provided on this website is for general informational purposes only. Hamilton Brown Partners assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided. Always speak to us or another registered professional before acting on any information read on this website.