Absentee Owner Surcharge Explained: A Guide to Land Tax

If you own property in Australia but reside overseas, you need to understand the absentee owner surcharge. It's a significant additional cost on top of standard land tax, levied by several Australian states.

This surcharge is essentially a premium for landowners who benefit from local infrastructure and services without residing in the state and contributing to its economy through other taxes. Understanding your obligations is the first step to managing your Australian property investments effectively.

- Your residency status, including the amount of time you spend in Australia.

- The ownership structure (individual, company, or trust).

- The state in which your property is located.

The absentee owner surcharge in Victoria is more than just a revenue-raising measure; it's a strategic policy tool designed to influence the property market and manage the impacts of foreign investment.

The underlying principle is fairness. Anyone owning land in Victoria benefits from its stable economy, public services, and infrastructure. The surcharge ensures that owners not contributing through other state-based taxes still pay their share for the maintenance of these community assets.

The Surcharge Has Increased Significantly

The current rate did not appear overnight. Its history shows a clear trend of increasing the financial contribution required from absentee owners.

The absentee owner surcharge in Victoria began at 0.5% in the 2016 land tax year. It increased to 1.5% for the 2017–2019 tax years, and then to 2% for 2020–2023. From the 2024 land tax year, the rate doubled to 4%. You can find detailed information on the impacts of Victoria’s foreign owner surcharge on the State Revenue Office (SRO) website.

This escalation signals a deliberate policy to increase the cost of passively holding Victorian land for foreign owners.

A Tool to Manage the Property Market

By making it more expensive for absentees to hold property, the government aims to achieve several outcomes:

- Encourage Local Investment: Higher holding costs can make local investment more attractive relative to foreign ownership.

- Increase Housing Availability: The surcharge can discourage "land banking," where properties are held vacant for speculative purposes, potentially freeing them up for development or for local buyers.

- Secure State Revenue: The funds raised contribute to the public services that all Victorians rely on.

At its core, the absentee owner surcharge is a balancing act. It ensures the privilege of owning Victorian land is accompanied by a fair contribution to the state's prosperity.

Determining If You Are an Absentee Owner

Correctly identifying whether you are an "absentee owner" is the first critical step. The definitions used by State Revenue Offices are specific and extend beyond simply where you live.

The rules vary for individuals, corporations, and trusts. For instance, an Australian-registered company can be classified as an absentee corporation if its control lies overseas. A foreign passport holder may not be an absentee owner if they reside in Australia for a sufficient period.

The Three Main Owner Categories

State Revenue Offices classify owners into three groups, each with its own set of rules for determining absentee status. For a deeper understanding of structuring your investments, it's helpful to know more about how we help clients determine the right structure for their situation.

Here are the primary categories:

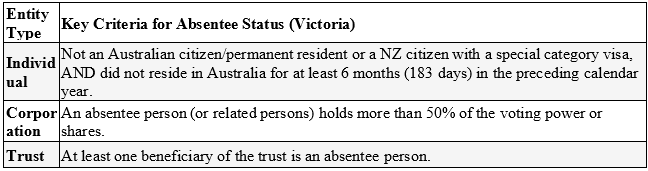

- Absentee Individuals: This generally applies to anyone who is not an Australian citizen or permanent resident, or a New Zealand citizen holding a special category (subclass 444) visa. Your physical presence is a key test; for example, in Victoria, you are an absentee person if you were not in Australia for at least six months (183 days) in the calendar year preceding the tax year.

- Absentee Corporations: A company is considered an absentee corporation if an absentee person has a ‘controlling interest’. This is typically defined as controlling over 50% of the voting power or owning more than 50% of the company's shares.

- Absentee Trusts: A trust is classified as an absentee trust if any of its beneficiaries is an absentee person. This means the surcharge can be triggered for the entire trust even if only one beneficiary qualifies as an absentee.

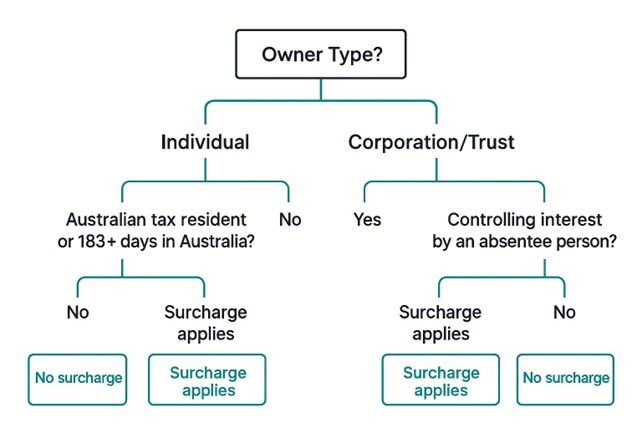

This decision tree helps visualise the basic questions that determine if the absentee owner surcharge applies to you.

As you can see, the logic is straightforward: for individuals, it's about residency status and time spent in Australia. For companies and trusts, it’s about who holds ultimate control or benefits.

Absentee Owner Classification Checklist

Use this checklist as a guide to see if you, your company, or your trust might be classified as an absentee owner.

This checklist provides a general overview. Since state rules have specific nuances, it's crucial to verify your status against the exact legislation in the relevant state. If you meet any of these criteria, you should investigate your obligations further.

How to Calculate Your Surcharge Liability

Understanding the financial impact of the surcharge is essential for managing your property investments.

The calculation is a percentage applied to the entire taxable value of your land. This surcharge is an additional amount payable on top of the standard land tax. Your total liability is your standard land tax plus the absentee owner surcharge, both calculated on your land's site value.

A Practical Calculation Example

Let's use an example to illustrate the real-world cost. Imagine you are an absentee owner with land in Victoria valued at $800,000. We will use the rates for the 2024 land tax year.

- General Land Tax: Calculated using the standard marginal rates and thresholds for that year.

- Absentee Owner Surcharge: A flat 4% of the $800,000 taxable value.

Surcharge Calculation: $800,000 x 4% = $32,000

This $32,000 is an additional charge you must pay solely due to your absentee status. It represents a significant annual holding cost.

While standard Victorian land tax is calculated using tiered rates, the surcharge applies to the full taxable value, adding a substantial cost from the first dollar. You can review current and past rates by checking the historical land tax and surcharge rates on the SRO website.

Accurate calculation is a non-negotiable part of effective tax planning for any property investor. Knowing your liability helps manage cash flow and avoid unexpected tax bills.

Navigating Exemptions and Concessions

Receiving an absentee owner surcharge assessment does not always mean you must pay the full amount. State governments provide avenues for exemptions, but these are discretionary and require you to demonstrate a tangible and positive contribution to the local economy.

Relief is not granted automatically. You must build a strong case showing that your land ownership benefits the state beyond being a passive investment.

Conditions for Gaining Relief

The Treasurer has the discretion to grant an exemption if they are convinced you are making a significant contribution to the economy. The criteria are specific and generally focus on these areas:

- Conducting significant commercial activities in Australia that benefit the local or state economy.

- Employing local workers and contributing to the Australian labour market.

- Engaging in substantial property development that creates housing or commercial infrastructure, generating jobs and adding community value.

These exemptions are considered on a case-by-case basis and require a formal application supported by strong evidence. For example, a developer building a housing estate has a much stronger case than an owner holding a vacant block of land.

The Application Process and What to Expect

To apply for an exemption, you must submit a formal request to the relevant State Revenue Office. This involves presenting a persuasive argument supported by evidence like financial records, employment data, and development plans.

The government does grant these exemptions when a compelling case is made. According to the Victorian SRO, for the 2022-2023 financial year, 454 exemptions were granted, waiving approximately $175.7 million in surcharges. These figures, available in the official absentee owner surcharge revenue statistics, show that a well-prepared application has a genuine chance of success.

Given the complexities, understanding different ownership structures can provide a significant advantage. For long-term asset management, exploring options like an SMSF with our expert guidance can be a strategic move.

Frequently Asked Questions

Here are answers to some of the most common questions about the absentee owner surcharge, based on Australian tax law.

Does This Surcharge Apply in Every Australian State?

No. Land tax is a state-based tax, so the absentee owner surcharge only exists in certain states.

Currently, you will encounter an absentee owner surcharge (or a similar foreign owner surcharge) in:

- Victoria (VIC)

- New South Wales (NSW)

- Queensland (QLD)

Tasmania also has a land tax surcharge for foreign owners. It is critical to check the specific rules in the state where your property is located, as rates and definitions of 'absentee' can vary significantly.

What Happens if My Residency Status Changes Mid-Year?

Your liability for the surcharge is determined based on your status on a single specific date—31 December of the preceding year.

This means your situation on that "snapshot" date determines whether you pay the surcharge for the entire following land tax year.

For example, if you were classified as an absentee owner on 31 December 2023, you will be liable for the surcharge for the full 2024 land tax year, even if you become a resident on 2 January 2024. This makes planning around this date crucial.

The bottom line is that timing is everything. A change in your circumstances after 31 December will not alter your tax

assessment for that year.

Can Australian Citizens Be Charged the Surcharge?

Yes, Australian citizenship does not provide an automatic exemption. The key factor is your residency and physical presence in Australia.

An Australian citizen who lives overseas and does not meet the relevant state's residency tests—such as being in Australia for a minimum number of days—can be classified as an absentee owner. Many Australian expats are caught by this rule, assuming their passport protects them.

Ultimately, liability is based on where you ordinarily reside, not the passport you hold. Always refer to the specific legislation of the relevant state for their precise definition.

Navigating the complexities of the absentee owner surcharge can be challenging. At THN & Samios Partners Pty Ltd, we provide clear, strategic advice to help you manage your tax obligations while remaining fully compliant. Let us help you protect your assets and enhance your returns with expert guidance on Australian property tax. Visit us online to see how we can help you build long-term financial confidence.

Disclaimer: The information provided on this website is for general informational purposes only. Hamilton Brown Partners assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided. Always speak to us or another registered professional before acting on any information read on this website.