Understanding The Land Tax Threshold

If you own investment property in Australia, you've likely encountered the term land tax threshold. So, what exactly is it?

Think of it as a tax-free allowance for property investors. Every state and territory government sets a total value of unimproved land you can own before you are required to pay land tax. This tax only applies to your investment properties—your principal place of residence is exempt.

Once the total unimproved value of your investment land crosses this threshold, you begin to pay tax, but only on the amount above that specific limit.

Your Guide To The Land Tax Threshold

For anyone holding investment properties, understanding the land tax threshold is critical for managing your annual costs. It acts as a starting line; you don't begin to incur tax until your portfolio's total land value crosses that state-specific point.

This state-based tax is calculated solely on the unimproved value of your land. This is a crucial detail. It means the state revenue office disregards the value of any buildings, landscaping, or other structures on the property.

It’s the land itself, not the dwelling on it, that is taxed.

This is why a modest house on a large, valuable block in a sought-after suburb could attract a much higher land tax bill than a brand-new luxury apartment that occupies a very small land footprint.

The visual below illustrates this point, showing how the assessment focuses on the land's value alone.

This concept is the foundation for how the land tax threshold is applied to your portfolio. It’s all about the value of the underlying land.

Why Does This Tax Exist?

At its core, land tax is a significant source of revenue for state and territory governments. It helps fund essential public services that benefit the entire community, such as schools, hospitals, roads, and emergency services.

The system is specifically designed to apply to those who own land as an investment, which is why your principal place of residence is almost always exempt.

The land tax framework is built on a few key principles:

- Progressive Taxation: The more valuable your total land holdings are, the higher the rate of tax you will pay.

- State-Based System: This is a critical point. Each state and territory sets its own rules, rates, and land tax threshold. There is no single national system.

- Aggregation: All the taxable land you own within a single state is added together to determine if you’ve crossed the threshold for that jurisdiction.

Because it's a state-based system, an investor with properties in both New South Wales and Victoria is assessed separately in each state. This means they can benefit from two different tax-free thresholds. Effective tax planning is essential for investors, just as it is for small business owners who need to stay current with the latest ATO tips for small business.

How Land tax Thresholds Differ Across Australia

If you own investment properties across Australia, you cannot view land tax as a single, national rule. Land tax is a state-based system, meaning every state and territory operates under its own distinct set of regulations. This is a critical point for any investor to grasp.

A property portfolio with a specific land value in New South Wales could face a completely different tax bill compared to an identical portfolio in Queensland. The differences are not minor. Each state sets its own land tax threshold—the value your unimproved land must reach before the tax applies. Additionally, they set their own tax rates, which typically increase as your land value grows.

This patchwork of regulations creates both challenges and opportunities. An investor may find themselves well over the threshold in one state but comfortably under it in another. This reality can and should influence strategic decisions about where to purchase future properties.

State And Territory Thresholds At A Glance

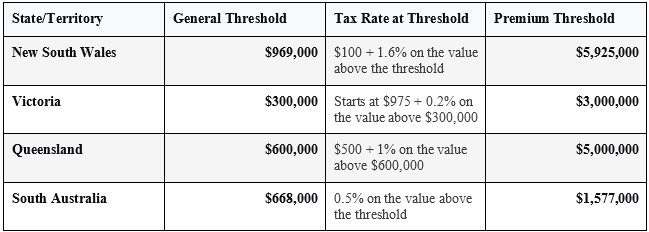

To provide a clear sense of the variation, let’s review the general thresholds and rates for individuals in several major states. The financial impact of these differences is significant and can directly shape your investment strategy.

Key Takeaway: Because land tax is assessed on a state-by-state basis, you can utilise the full tax-free threshold in each jurisdiction where you own property. For investors building a national portfolio, this is a strategic advantage. It allows for diversification that can help keep your overall tax liability as low as possible.

The table below provides a snapshot of how different the figures can be. It is important to remember that these figures are subject to change, so this should be used as a guide. Always verify the most current information with the relevant state revenue office.

State And Territory Land Tax Thresholds And Rates

Here is a comparison of the general land tax thresholds and initial tax rates for individuals in major Australian states for the 2023-24 financial year. This table highlights how drastically the starting point for land tax can differ.

Note: Data is for individuals and is simplified for comparison. Rates are progressive, and other thresholds, levies, or surcharges may apply.

As you can see, the gap between states like Victoria and New South Wales is substantial, directly affecting when and how much tax you will pay.

Why These Differences Matter For Investors

The significant variance in land tax thresholds directly impacts your investment returns. A low threshold, like Victoria's $300,000, means investors start receiving tax bills much sooner than they would in NSW, which has a far more generous $969,000 threshold.

This reality requires savvy investors to think strategically about several key factors:

- Portfolio Diversification: Spreading investments across different states is one of the most effective ways to utilise multiple tax-free thresholds and minimise your overall land tax burden.

- Purchase Timing: Being mindful of valuation dates is important, as a new purchase could push your aggregated land value over the threshold for that financial year.

- Ownership Structure: The way you hold a property—as an individual, in a company, or through a trust—can also lead to vastly different land tax outcomes depending on that state's specific rules.

Ultimately, ignoring these jurisdictional differences can lead to unexpected tax bills that erode your profits. A clear understanding of each state's land tax threshold is not just good practice; it is a fundamental pillar of any successful Australian property investment strategy.

Calculating Your Land Tax Assessment

Knowing the land tax threshold is the first step, but understanding how the calculation applies to your portfolio is where the concept becomes practical. The calculation itself is straightforward but relies on two key ideas that every property investor must understand.

The process is simple: your state’s revenue office determines the total value of all your taxable land, subtracts the land tax threshold, and then applies the relevant tax rate to the remaining amount.

The Foundation: Your Unimproved Land Value

The starting point for any land tax calculation is the unimproved value of your land. This is the official term for what your block of land would be worth on the open market if it were completely empty—with no house, shed, or landscaping.

This figure is not an estimate. It is an official valuation conducted annually by an independent authority in your state, such as the Valuer General. This single number is the basis of your entire land tax assessment.

The concept behind this is that land tax is a tax on the land itself, not the building sitting on it. This is why two properties with identical houses can have vastly different land tax bills if one is on a larger or more valuable piece of land.

Understanding Aggregated Land Value

State revenue offices do not assess each of your properties individually. Instead, they calculate your aggregated land value. This means they sum the unimproved value of all the investment properties you own in that specific state.

This total figure is then measured against that state's land tax threshold. It’s a crucial concept because purchasing just one more property can easily push your aggregated value over the limit, resulting in your first land tax bill.

A Tale Of Two States: A Calculation Example

To see how much the threshold can impact your final bill, let's compare the outcomes for an investor with a total land holding valued at $1,000,000 in two different states.

- Scenario 1: New South Wales The general threshold for an individual in NSW is $969,000. Our investor's land value is over this by $31,000. The tax is a flat $100 plus 1.6% of that excess amount, which results in a modest bill of approximately $596.

- Scenario 2: Victoria In Victoria, the threshold is much lower at $300,000. This means the investor's land value is over the limit by $700,000. Because the tax is calculated on a progressive scale, the final bill is significantly higher at around $2,175—for the exact same land value.

This stark difference demonstrates why you must know the specific rules for each state. Proactive tax planning can make a substantial difference to your annual holding costs. To ensure you’re staying ahead, review our expert insights on EOFY tax planning for 2025.

Where Did Land Tax Even Come From?

To fully understand the land tax threshold today, it is helpful to look at its historical roots. Land tax is not a new concept; it has a long and interesting history in Australia.

Originally, it was introduced to achieve two main goals: fund the development of the states and encourage the breakup of the massive rural estates that were common in the colonial era. The objective was to incentivise landowners to use their land productively.

In the late 19th century, vast tracts of agricultural land were owned by a small number of people. Much of this land remained undeveloped as owners waited for its value to appreciate. Governments viewed this as a barrier to progress and devised a tax to stimulate activity.

The solution was a tax based not on the property's total value, but on the unimproved value of the land itself. This was a direct measure to penalise land hoarding and reward those who improved their land.

South Australia: The Pioneer

The idea of taxing raw land value gained momentum, and one state was well ahead of its time. South Australia became the first jurisdiction in the country to introduce a land tax based purely on unimproved land values, passing its groundbreaking law in 1884.

This move set a precedent for other states. It established land tax as a powerful tool for both raising revenue and driving economic policy. Even today, South Australia’s system reflects this history, with its progressive rates applying once a landowner’s total holdings exceed the state threshold. You can see how the rates have evolved on the RevenueSA website's page for previous land tax thresholds.

How It’s Changed For Modern Property Markets

Over the last century, the primary purpose of land tax has shifted. While it still encourages efficient land use, its main role today is to fund essential state services like hospitals, schools, and emergency services. This evolution has led states to continually adjust their land tax thresholds and rates.

This is particularly evident in states with booming property markets, such as Victoria and New South Wales. As land values have surged, governments have been compelled to raise the land tax threshold regularly. This is done to prevent everyday investors from being unexpectedly hit with a significant tax bill simply due to market growth.

The constant adjustments to the land tax threshold are a direct response to the property market. Without these changes, soaring property prices would drag thousands of smaller investors into the land tax system each year due to 'bracket creep'.

This historical context is more than a trivia point for investors. It shows that the land tax threshold is not an arbitrary number. It is a policy lever influenced by the economy, political decisions, and a legacy that is over a century old. This knowledge helps explain why the rules can be so different from one state to the next.

How To Strategically Manage Your Land Tax

Simply paying your land tax bill when it arrives is a missed opportunity. For savvy investors, the annual assessment is not just another expense—it's a prompt to think strategically about how to legally minimise it.

This is not about tax avoidance; it is about smart, proactive tax management. By understanding how the state-based systems work, you can structure your portfolio to reduce what you owe and maximise your returns. The most effective strategies often involve where you buy and how you hold your properties.

Diversify Your Portfolio Across State Lines

One of the most straightforward and effective ways to manage your land tax liability is to spread your investments across different states. Because each state assesses land tax independently, this strategy allows you to take advantage of multiple tax-free thresholds.

This approach avoids concentrating all your risk and tax liability in one jurisdiction.

If you focus all your investment properties in a state with a low land tax threshold, like Victoria, you can quickly find your total land value pushed into a much higher tax bracket. However, if you purchase your next property in Queensland or New South Wales, you begin again with a new, separate threshold.

This strategy effectively resets your land tax liability for each new state you invest in. Instead of one large, aggregated land value in a single state, you create several smaller portfolios, each potentially falling under its respective state's threshold.

Choose The Right Ownership Structure

Just as important as where you buy is how you own your properties. The ownership structure you select can dramatically alter your land tax assessment, as different entities are often treated very differently by state revenue offices.

Holding property in your personal name is simple, but it may not be the most tax-effective method as your portfolio grows. Exploring other options with a financial advisor is a critical step.

- Individuals or Joint Tenants: Owning property as an individual, either solely or with a partner, typically provides access to the full general tax-free threshold. It is the simplest and most common structure for new investors.

- Trusts: A trust can offer excellent asset protection and estate planning benefits. However, be aware that many states apply a surcharge or a lower (or even zero) tax-free threshold for properties held in a trust.

- Companies: Owning property through a company separates your personal and investment assets. However, companies may also face higher land tax rates or different thresholds, so it is important to weigh the pros and cons.

There is no single correct answer. The optimal structure depends on your personal circumstances, investment goals, and the specific rules of the state where you are investing.

Establishing the right structure from the outset is a cornerstone of a sound investment strategy. Because the financial implications are significant, professional advice is essential. We strongly recommend exploring detailed resources on effective tax planning to ensure you make the most informed decision.

Common Questions About The Land Tax Threshold

As investors begin to understand the basics, several specific questions about the land tax threshold typically arise. Let's address some of the most common ones to provide further clarity.

Is My Family Home Subject To Land Tax?

For most Australians, the answer is no. Your principal place of residence—your family home—is generally exempt from land tax in every state and territory. This is a fundamental principle of the system, which is designed to target investment assets, not the home you live in.

However, the exemption is not always absolute. If you use part of your home exclusively for business purposes or rent out a section, you could lose a portion of that tax-free status. The rules on this are highly specific, so it is wise to check with your state's revenue office to be certain of your position.

What If I Own Investment Properties In Different States?

This is where the state-by-state nature of land tax can work to your advantage. Each state assesses your land holdings completely independently. This means you can claim the full land tax threshold in every single state where you own an investment property.

For example, an investor with properties in New South Wales, Victoria, and Queensland can use three separate tax-free thresholds. Their NSW land is assessed against the NSW threshold, their Victorian land against Victoria’s threshold, and so on.

This separation is a powerful strategic tool. By diversifying a portfolio across state lines, an investor can significantly reduce their overall land tax bill compared to holding all properties in one state, particularly one with a low threshold.

How Is My Land's Value Determined For Tax?

The figure used for your land tax assessment is the unimproved land value. This is the market value of your block of land as if it were vacant—with no house, landscaping, or driveway.

This is not an arbitrary estimate. It is a formal valuation calculated annually by a state authority, typically the Valuer General. They use recent sales data and market trends in your local area to determine the figure. If you receive your assessment and believe the valuation is incorrect, you have a formal right to object.

Are Other Land Tax Exemptions Available?

Yes. Beyond the principal place of residence exemption, states offer a range of other concessions and full exemptions. It is crucial to be aware of what is available, as you could be missing out on significant savings.

Common exemptions often include:

- Primary Production Land: Land used for farming or other primary production activities is almost always exempt.

- Charitable Institutions: Properties owned and used by registered charities, religious bodies, or non-profit organisations typically do not attract land tax.

- Retirement Villages and Aged Care: Land used for these specific purposes often qualifies for a full or partial exemption.

- Concessions for Development: To encourage new housing supply, some states offer temporary land tax relief on land that is under development.

These rules can be complex and vary significantly between states. It is always worthwhile to review your local state revenue office’s website to ensure you are claiming every exemption for which you are eligible. Paying unnecessary tax directly reduces your investment returns, so proactive management is essential.

Navigating the complexities of land tax, SMSF rules, and strategic tax planning requires expert guidance. At THN & Samios Partners Pty Ltd, we provide proactive advice to help business owners and investors protect their assets and enhance their financial position. Discover how our tailored accounting services can bring clarity and confidence to your financial strategy by visiting us at https://www.samiospartners.com.au.

Disclaimer: The information provided on this website is for general informational purposes only. Hamilton Brown Partners assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided. Always speak to us or another registered professional before acting on any information read on this website.