Virtual Chief Financial Officer for Australian Businesses

A virtual chief financial officer provides top-tier financial strategy to your business on a remote, part-time basis. This service offers access to high-level expertise without the cost of a full-time executive salary, focusing on future growth rather than just past performance.

- Actionable Insights: They translate complex financial reports into plain English. Instead of just seeing a profit figure, you’ll understand which products are most profitable, where costs are increasing, and what specific actions you can take to improve performance.

- Improved Decision-Making: Key decisions—such as hiring new staff, investing in equipment, or adjusting pricing—are no longer based on gut feelings. A vCFO supports these moves with solid data and financial modelling.

- Sustainable Growth: They help you manage cash flow, position your business for funding, and build a resilient financial foundation for long-term success.

- Strategic Financial Planning: They help build a long-term financial roadmap aligned with your business goals, ensuring you have the resources to achieve them.

- Cash Flow Optimisation: This involves proactively managing cash. A vCFO creates detailed cash flow forecasts to identify potential shortfalls months in advance, helping you avoid liquidity issues.

- Insightful Forecasting and Budgeting: They build dynamic financial models to simulate scenarios. For instance, they can project the financial impact of hiring new staff or investing in major equipment.

Your Advisor in Major Business Decisions

The value of a virtual chief financial officer is most apparent when facing major business decisions like scaling, securing funding, or planning an exit strategy. They ensure your financial house is in order to seize opportunities and mitigate risks.

This involves core functions distinct from routine accounting:

- Securing Funding: They prepare professional-grade financial projections and business plans that banks and investors require, improving your chances of securing capital.

- Preparing for Growth: They help you understand the true costs of scaling, ensuring your pricing, margins, and cash flow can support expansion.

- Building Financial Resilience: They identify hidden weaknesses, such as over-reliance on a single customer or an inefficient cost structure, and develop strategies to strengthen the business.

The CFO's role in Australia has expanded significantly beyond numbers. The FTI 2025 CFO Report for Australia found that 92% of Australian CFOs now lead business-wide digital projects, a significant increase from 68% in 2020. This shift is driven by technology, with 40% of Australian SMEs now viewing their vCFO as a ‘strategic partner,’ up from just 12% in 2020.

Ultimately, a vCFO provides the high-level financial oversight that ambitious businesses need to thrive. They bridge the gap between daily bookkeeping and long-term strategic vision, ensuring every financial decision is a deliberate step toward your goals.

The Financial Case for a Virtual CFO

When your business is scaling, you often need high-level financial strategy long before you can justify the budget for a full-time Chief Financial Officer. This is where a virtual chief financial officer offers a practical solution.

Engaging a vCFO is not just a cost-cutting measure; it’s about accessing C-suite expertise in a financially sustainable way. It allows you to leverage top-tier strategic thinking without the significant cost of a permanent executive salary.

The True Cost of a Full-Time CFO

Hiring a full-time, in-house CFO is a major financial commitment, and the base salary is just the start. For many Australian businesses, the total cost is prohibitive.

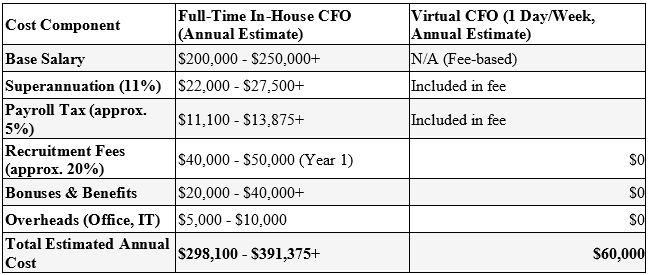

Here’s a breakdown of the typical costs involved:

- Base Salary: An experienced CFO in a major Australian city can command a salary starting well over $200,000 per year.

- Superannuation: The mandatory superannuation guarantee contribution (currently 11% as of 1 July 2023) must be added.

- Payroll Tax: This state-based tax adds another significant cost, with rates varying by state (e.g., NSW is 5.45%, VIC is 4.85%).

- Overheads: Additional costs include recruitment fees, bonuses, paid leave, professional development, and office expenses like a desk and laptop.

These costs can easily push the total annual investment for one executive role towards $300,000 or more.

A Smarter, More Flexible Investment

A virtual CFO changes this financial equation. Instead of a fixed full-time salary, you pay for specific expertise as you need it. This fractional model provides significant cost benefits without compromising the quality of financial leadership.

Let's break down the difference in a simple comparison.

Cost Comparison Full-Time CFO vs Virtual CFO in Australia

This table provides a clear, at-a-glance view of the estimated annual costs, highlighting the stark contrast between a traditional in-house role and a flexible virtual engagement.

The savings are substantial, which is a key driver for the growing demand for vCFO services in Australia.

This infographic also shows how the role itself has evolved. A modern vCFO is no longer just a numbers person; they're a strategic partner and a digital leader.

Businesses now rely on vCFOs for high-level thinking and technology guidance, not just traditional financial reporting.

Calculating Your Return on Investment

Perhaps the most compelling aspect of engaging a virtual CFO is their ability to generate a tangible return. Their fee is a strategic investment designed to increase your profits and build long-term value.

A good vCFO can pay for themselves many times over by:

- Identifying Cost Savings: Analysing expenses to find inefficiencies and negotiating better terms with suppliers.

- Optimising Pricing Strategies: Ensuring your pricing maximises profit without alienating customers.

- Improving Cash Flow: Using forecasting and management to free up working capital and reduce financing costs.

- Guiding Growth Opportunities: Building financial models to confidently pursue new markets or launch new products.

By focusing on these high-impact areas, a virtual CFO makes a direct contribution to your bottom line, making it one of the smartest investments a growing business can make.

Managing Your Financial Risk and Compliance

For any Australian business owner, managing risk and compliance is a significant responsibility. It extends beyond lodging your BAS on time to building a financially resilient business that can withstand audits, regulatory changes, and economic shifts.

A virtual chief financial officer acts as your financial guardian in this complex landscape.

Their role is to ensure your business meets all its obligations to the Australian Taxation Office (ATO) and other regulators. This includes overseeing everything from GST and PAYG withholding to fringe benefits tax and superannuation contributions, ensuring full compliance with Australian law. This expert oversight provides peace of mind and allows you to focus on running your business.

Proactively Identifying and Mitigating Risks

A great virtual CFO doesn’t just react to problems—they prevent them. They actively analyse your financial data to identify potential weaknesses before they cause damage. This is about protecting the long-term health of your business.

This proactive approach includes:

- Spotting Cash Flow Vulnerabilities: Identifying over-reliance on a single major client and suggesting strategies to diversify income streams.

- Fixing Inefficient Pricing Models: Analysing margins to pinpoint underpriced services or products, helping you adjust your strategy to improve profitability.

- Strengthening Internal Controls: Implementing robust financial processes to reduce the risk of costly errors or internal fraud.

- Think of a virtual CFO as an early warning system. They spot financial risks on the horizon, giving you ample time to adjust course rather than reacting to a crisis.

Staying Ahead of Regulatory Change

Australian business regulations are constantly evolving. What was compliant last year might not be this year. The virtual CFO is a game-changer for startups and SMEs in 2025 on cfoaustralia.com.au, with industry analysis showing that businesses with vCFOs often see a reduction in compliance-related issues and resolve audits faster.

For example, if the ATO announces new, stricter record-keeping requirements for your industry, a vCFO ensures your systems and processes are updated to meet these standards, protecting you from potential penalties. They stay across legislative changes from Treasury and updates from the ATO.

Our guide on ATO compliance in 2025 provides more detail on what to expect. With this expert guidance, compliance shifts from a stressful burden to a well-managed part of your business.

How to Hire the Right Virtual CFO

Finding the right virtual chief financial officer is like finding a business partner. The right fit can be a game-changer for your growth, while the wrong one can lead to frustration. The process should begin with a clear assessment of your business needs.

Before you start your search, define what success looks like. Are you struggling with cash flow? Preparing to pitch to investors? Or planning to scale and need a clear financial roadmap?

Be specific about your goals. Writing down a checklist clarifies your priorities and becomes the foundation of your search, helping you filter candidates and ask the right questions.

Defining Your Core Requirements

Create a practical needs assessment to guide your hiring process. When you know which problems you need to solve, you can quickly identify a vCFO with the right skills.

Consider these key areas for your checklist:

- Strategic Goals: Are you aiming to increase profitability by 15%? Secure a funding round within 12 months? Or prepare the business for a future sale?

- Operational Pain Points: What is your biggest current challenge? Is it a lack of cash flow visibility, a cumbersome budgeting process, or making financial decisions without clear data?

- Technology Stack: What accounting software do you use? Proficiency in platforms like Xero or MYOB is essential for a seamless partnership.

- Industry Nuances: Do you operate in a specialised sector with unique compliance rules? A vCFO with experience in your industry can provide invaluable, context-specific advice.

This exercise transforms your search into a targeted mission to find the perfect strategic partner for your specific challenges.

Key Questions to Ask Potential vCFOs

The interview is your chance to assess technical skills, relevant experience, and communication style. You need someone who can not only analyse the numbers but also explain their meaning in plain English and provide clear, actionable advice.

Here are some essential questions to guide your conversations:

- Industry and Business Model Experience: "Can you provide an example of how you helped a business similar to ours overcome a challenge like [mention your specific pain point]?"

- Technology Proficiency: "How do you use platforms like Xero or MYOB for strategic analysis beyond basic reporting? What other forecasting or analytics tools do you use?"

- Communication and Reporting Style: "What is your preferred communication rhythm—weekly calls, monthly reports, real-time dashboards? Can you show me a de-identified example of a report you would prepare for us?"

- Measuring Success: "How will we measure the success of this partnership? What key performance indicators (KPIs) would you recommend we track?"

Their answers will reveal their expertise, their thought process, and whether their approach aligns with your business culture.

A great virtual CFO doesn’t just answer your questions; they ask their own. They should be genuinely curious about your business, goals, and challenges. This curiosity indicates they see themselves as a true partner.

Understanding Engagement Models and Agreements

Virtual CFO services are not one-size-fits-all. They are typically offered in different models to match varying business needs and budgets.

- Project-Based: Ideal for specific, one-off tasks like preparing for a capital raise, managing due diligence for an acquisition, or overhauling financial reporting systems.

- Monthly Retainer: The most common model, providing ongoing strategic support for a fixed monthly fee. This gives you consistent financial oversight and access to advice.

When you are ready to proceed, review the service agreement carefully. It should clearly define the scope of work, communication protocols, fee structure, and deliverables. Clarifying these terms and KPIs from the outset is crucial for building a successful, long-term partnership.

Your Questions About Virtual CFOs, Answered

As the concept of a virtual chief financial officer becomes more common, it’s natural for business owners to have questions. Understanding the details is the first step to making an informed decision for your business.

Here are answers to some of the most common queries from Australian business owners.

What's the Difference Between a Virtual CFO and an Accountant?

This is the most critical distinction. You need both for a healthy business, but they perform very different roles.

Your accountant is focused on the past. They are experts in recording historical transactions accurately, ensuring compliance with the ATO, and lodging your tax returns. They provide a precise snapshot of your financial history.

A virtual CFO, on the other hand, is focused on the future. They use the historical data provided by your accountant to create a strategic roadmap for your business. Their role is to help you decide what to do next to drive growth and improve profitability.

Think of it this way: your accountant is the historian of your business, ensuring past records are accurate. Your virtual CFO is the strategist, using those records to chart a course for future success.

When Should My Business Hire a Virtual CFO?

There isn't a specific revenue threshold that signals it's time. Instead, look for clear signs that your business has outgrown basic accounting and requires high-level strategic guidance.

You should consider a vCFO if you experience any of the following:

- You're bogged down in finances: You spend too much time on spreadsheets and financial worries instead of focusing on core business operations.

- You need professional financial reporting: You are seeking investment, applying for a significant loan, or reporting to a board and require robust financial models and forecasts.

- Cash flow is a constant challenge: Revenue may be growing, but cash feels tight and unpredictable, making it difficult to plan for major expenses.

- You're planning for growth: You are preparing to expand, enter a new market, or launch a new product and need a solid financial plan.

- You feel you're making decisions in the dark: You lack the clear, high-level financial insights needed to make major decisions with confidence.

For most ambitious Australian SMEs, the right time is when you decide to proactively build a strong financial foundation for growth, rather than waiting for a problem to arise.

How Does a Virtual CFO Actually Fit into My Team?

A vCFO integrates into your team through modern technology and structured communication, becoming a remote member of your leadership team rather than an external consultant.

This integration is achieved through:

- Shared Technology: Cloud accounting software like Xero or MYOB ensures everyone works from the same live data, creating a single source of truth.

- A Regular Rhythm: They establish a consistent meeting schedule—typically weekly or fortnightly—to review performance, discuss strategy, and provide clear, actionable advice.

- Collaboration with Your Team: They work closely with your existing bookkeeper or accountant to ensure the underlying data is accurate, which is essential for sound strategic advice.

- Open Lines of Communication: They are available via email, phone, or video calls for quick questions and ongoing guidance, acting as a true advisor.

They become a trusted partner who understands your business, works with your people, and is invested in your success.

What Tools and Technology Do They Use?

A modern virtual CFO service operates on a smart stack of digital tools that enable them to deliver C-suite-level insights remotely and efficiently.

The typical tech setup includes:

- Cloud Accounting Software: This is the foundation. Platforms like Xero, QuickBooks, or MYOB are essential for real-time access to your financial data.

- Reporting and Forecasting Tools: To supplement accounting software, they use more advanced tools for Financial Planning & Analysis (FP&A), such as Futrli, Spotlight Reporting, or Fathom. These are used to build detailed forecasts, custom dashboards, and track key performance indicators (KPIs).

- Communication Hubs: To maintain organisation and team alignment, they use platforms like Microsoft Teams, Slack, or Asana for communication and task management.

This technology stack ensures your financial information is not just accurate but also presented in a clear, actionable, and up-to-date format.

At THN & Samios Partners Pty Ltd, we provide the strategic financial leadership your business needs to move beyond basic compliance and achieve real, sustainable growth. If you're ready to gain clarity, improve profitability, and build a stronger financial future, we're here to help. Contact us today to learn how our business services can benefit you.